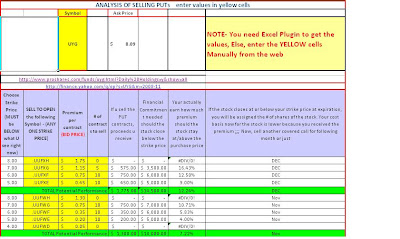

Here, we discuss examples of selling PUTs. Take a look at the captured image from the spreadsheet that was used to perform the analysis. You can try something along these lines for various equities.

Analyse how one can generate an income for November / December for UYG in this example for various positions. For the conservative trader, the lower values sold are the best. For those who beleive that ultimately a stock will go up, they can use this to own the stock at a lower price.

Here is a brief tutorial on how selling PUTs works (this has been discussed previously on my blog; as well as several sources exist on the web).

---- Selling PUTs can be applied to either earn premium if Strike Price (SP) is not reached [Implying that the stock will not go down too much], or if a trader won't mind to buy a stock at a lower price. Of course, margin requirements have to be met with the brokerage firm so as to fulfill the obligation should a stock go down & hit the SP.

The obligation that a trader has is that if the stock closes at that strike price (SP) at expiration, the trader will buy the stock.

This is considered as a way to earn premium if it does not reach the SP, or a way to get a stock at a cheaper price because trader has pocketed the premium in advance.

If SP is not reached, trader keeps the premium. The premium received divided by the obligation to purchase is the ROI.

If SP is reached, then:

- The trader owns the stock at a lower price than SP, & can hold on to the stock or can turn around & sell a covered call against the holding.

- Or, if the trader does not want to own the stock & wants to bail out & not purchase the stock, then a reverse order needs to be executed to "buy back" (Buy to Close) the PUT & incur some loss/profit.

Position can be closed at a profit (if stock goes up, PUT loses value) or loss ( if stock goes down, PUT gains value) even prior to reaching the SP by simply buying back the PUTs

...................................................

No comments:

Post a Comment